Gas power stations in the UK

Natural gas power has been crucial in the UK’s energy transition, providing reliable electricity while pivoting in the rapid phase-out of coal. As the country moves towards net-zero targets, natural gas remains key, but its dominance is expected to wane with the 2035 deadline to phase out unabated gas power.

This article delves into the past, present, and uncertain future of natural gas in the UK’s energy landscape.

Contents

- A brief history of natural gas power in the UK

- How is gas power distributed?

- Types of gas power station in the UK

- Where are the UK’s gas power stations?

- Who owns the UK’s gas power stations?

- How do gas power stations affect the price of electricity?

- The future of gas power in the UK

A brief history of natural gas power in the UK

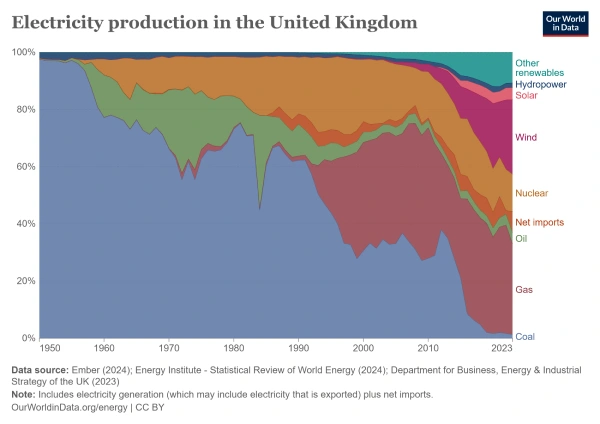

Natural gas power is a relatively recent development in the UK. Although the first natural gas power station, Didcot A, was commissioned in the 1970s, it wasn’t until the “Dash for Gas” in the 1990s that it became a major contributor to the national grid.

By the turn of the millennium, natural gas powered one-third of the UK’s electricity supply.

Four key factors drove this surge in gas power development:

- Abundant gas supply: Large-scale North Sea gas production in the 1990s made natural gas economically viable.

- Market liberalisation: Privatisation of the electricity market in 1990 encouraged private companies to invest in gas power.

- Environmental regulations: Stricter pollution laws favoured cleaner-burning natural gas over coal.

- Innovation: CCGT technology improved efficiency, making gas more competitive for power generation.

The expansion of natural gas power continued over the next three decades, peaking in 2008 when gas power stations met nearly half of the UK’s electricity demand with a colossal 177 TWh.

Fast-forward to 2024, and natural gas remains the leading energy source in the UK, accounting for 28% of the nation’s power demand despite the rapid growth in renewable energy.

How is gas power distributed?

Gas power stations typically operate around the clock, serving as a reliable baseload and peak-demand electricity source.

Most large gas power stations are connected to the UK’s high-voltage transmission network (the national grid). From there, electricity is distributed to consumers through local grids managed by Distribution Network Operators (DNOs).

Some medium and smaller gas power stations are connected directly to the low-voltage network, efficiently meeting local demand. Some are called “peaking” plants, designed to provide additional power during periods of high demand.

Types of gas power station in the UK

Despite their similar appearance, there are multiple gas power stations, each serving a different purpose.

The vast majority of the capacity comprises a single technology: Combined Cycle Gas Turbine (CCGT), in which both a gas and steam turbine are used to generate the most electricity efficiently and on a large scale.

The UK’s fleet of 31 CCGT plants forms the bulk of baseload gas power, while other types serve smaller yet essential services and produce cheap power at scale.

For instance, Combined heat and power (CHP) stations generate electricity and capture and use the excess heat for nearby industries or district heating, maximising efficiency.

Moreover, “Peaking” or open-cycle gas plants can rapidly switch on at short notice to meet any sudden or expected spikes in electricity demand, providing power when the grid needs extra support. These open-cycle plants are paid using BSUoS charges for their grid balancing services.

Here is a summary of each of the technologies and their respective number of plants and total capacity:

| Type | Description | Total Capacity (MW) | Number of Stations |

|---|---|---|---|

| Combined Cycle Gas Turbine (CCGT) | Efficient for both base and peak loads by capturing waste heat. Requires longer ramp-up but higher efficiency compared to single cycle. | 26,548 | 31 |

| Simple/Open Cycle Gas Turbine (Single Cycle) | Quick start, ideal for handling peak demand or emergency backup. Less efficient due to no heat recovery. | 1,458 | 14 |

| Combined Heat and Power (CHP) | An add-on to CCGT or Single Cycle, capturing heat for industrial use or district heating, increasing overall efficiency. | 4,058 | 5 |

| Total | 32,064 | 50 |

💡 Gas power stations’ ability to act as both baseload and to meet “peaking” demand makes it the cornerstone of the grid. No other power source besides coal power and storage hydro can be ramped up or down on demand, even at short notice.

Where are the UK’s gas power stations?

The fleet of 50 British gas power stations is distributed across the island with clear clusters on the East Coast, especially:

- Near important natural gas pipelines arriving from the North Sea.

- Near industrial regions like Yorkshire and the East Midlands.

- Near high-demand areas like London.

Here is their distribution and capacity by region:

| Region | Number of Power Stations | Installed Capacity (MW) |

|---|---|---|

| East Midlands | 10 | 6,936 |

| East of England | 5 | 2,498 |

| London | 3 | 518 |

| North East | 2 | 170 |

| North West | 4 | 1,885 |

| Northern Ireland | 2 | 1,029 |

| Scotland | 1 | 1,180 |

| South East | 10 | 7,437 |

| South West | 4 | 2,239 |

| Wales | 2 | 3,579 |

| West Midlands | 1 | 100 |

| Yorkshire and the Humber | 6 | 4,493 |

| Total | 50 | 32,064 |

Who owns the UK’s gas power stations?

The UK energy industry is fully deregulated. This means that any company worldwide with a local subsidiary is eligible to build, own and operate power stations.

Here is a list of the corporate owners of gas power stations in the UK:

| Company (HQ) | Description | Number of Stations | Capacity Owned (MW) |

|---|---|---|---|

| RWE Npower (Germany) | German energy giant, focused on electricity | 9 | 7,139 |

| SSE Group (UK) | Part of the same group that owns SSE Business Energy. | 7 | 4,844 |

| Vitol (Switzerland) | Global energy and commodities trader, also owns energy assets | 5 | 3,268 |

| EPUKi (Czech Republic) | Czech energy infrastructure company | 3 | 2,886 |

| Intergen (Canada/UK) | International power producer | 4 | 2,860 |

| Uniper UK (Germany) | German-based power generation company | 4 | 2,818 |

| ESB (Ireland) | Ireland's leading energy provider | 3 | 1,730 |

| UK Transition Limited (UK) | UK-based energy transition company | 1 | 1,332 |

| Energy Capital Partners (USA) | US private equity firm focused on energy | 1 | 1,200 |

| Marchwood Power (UK) | UK power station operator | 1 | 898 |

| Calon Energy (UK) | UK energy generation company | 1 | 850 |

| River Nene (UK) | Local UK energy provider | 8 | 634 |

| Sembcorp Utilities (Singapore) | Singaporean utilities and energy firm | 1 | 120 |

| PX Group (UK) | UK-based operator of power infrastructure | 1 | 105 |

While these companies typically employ British staff for day-to-day operations and pay tax in the UK, a portion of the profits will always be diverted onto the parent corporation for global re-distribution.

How do gas power stations affect the price of electricity?

Gas power stations set the price of all electricity sold in variable rate contracts due to the country’s antiquated “marginal cost” pricing system, in which the most expensive kW generated (usually from a gas power station) sets the price.

In this section, we’ll explain how the marginal cost system causes business gas rates and business electricity prices to track each other.

Electricity is expensive because gas is expensive.

In the “marginal cost” system, the most expensive generator sets the half-hourly price per kWh of electricity at any given time, regardless of its contribution.

So even in days when UK wind farms are generating the bulk of the grid’s power at almost no cost, the price that business energy suppliers must pay for the electricity is set by the price of the natural gas burnt to generate electricity.

If gas is expensive and electricity is generated at 6 pence per kWh, all the electricity bought during that time from the spot market will be priced at 6 pence per kWh.

In summary, there is a very strong link between the price of gas and electricity, and this will remain as long as the “marginal” pricing system continues, even with declining gas power output.

When did gas power become the “marginal producer”?

Throughout the 1990s and 2000s, coal-fired power stations were often the highest-cost generators, especially as environmental regulations increased and carbon pricing was introduced.

However, by the late 2000s and early 2010s, natural gas started to play a larger role in setting prices as coal use declined and was eventually phased out, and cheap renewables were incorporated into the grid.

In 2021, the price of natural gas spiked due to low natural gas storage levels, a chronic lack of infrastructure investment, and geopolitical tensions, particularly Russia’s invasion of Ukraine in 2022, culminating in a nationwide energy crisis.

Since then, the British fleet of gas-fired power stations has relied on expensive liquified natural gas to replace cheap piped gas from Russia.

The future of gas power in the UK

The future of gas power in the UK is closely linked to achieving its legally binding goal of net-zero carbon emissions by 2050.

However, the decarbonisation of the national grid is well on its way, with coal power essentially phased out and renewables now comprising nearly 40% of the UK’s energy mix.

The UK government aims to phase out unabated natural gas power by 2035, but this will depend on the UK’s ability to build a reliable and flexible energy grid based on nuclear power for baseload supply.

Gas power stations equipped with carbon capture, utilisation, and storage (CCUS) may be allowed to operate beyond 2035, but the technology remains economically challenging.

In summary, while gas power’s contribution is expected to decline over time, the 2035 phase-out target should be taken with a grain of salt.

The 2050 net-zero deadline is legally binding, but significant uncertainties remain about how and when the transition will be fully realised.