Trading on the British wholesale electricity market

The wholesale electricity market matters because it sets the price of power for homes, businesses, and industries across Britain. It plays a vital role in keeping the electricity grid reliable for everyone.

Unlike most other markets, electricity bought on the wholesale market isn’t physically delivered.

Instead, it flows through the National Grid, a shared system where power is generated and consumed in real time. This makes the wholesale electricity market uniquely complex.

Our guide explains how the wholesale electricity market works, who takes part, and why it matters for everything from energy bills to climate targets.

What is the wholesale electricity market?

Since the 1990s, the British energy market has been privatised, allowing companies to generate and supply power with the aim of making a profit.

The wholesale electricity market was created to allow these private companies to buy and sell the power that flows through the national grid.

In its simplest form, the wholesale electricity market allows energy suppliers to purchase the power their customers use from the companies that generate electricity.

This guide explains the following three core aspects of the wholesale electricity market:

- Wholesale electricity market participants

- How electricity is traded

- Wholesale electricity market settlement

Wholesale electricity market participants

The wholesale electricity market allows electricity to be traded between buyers and sellers.

Below is a list and explanation of the key buyers and sellers actively trading on the British wholesale electricity market.

Electricity generators

Role: Seller

Electricity generators produce and supply electricity to the national grid. The three largest types of generators in Britain, along with their percentage contributions, are listed below.

- UK wind farms (30%) – Provide the largest share of electricity generation, from a mix of onshore and offshore turbines.

- Gas power stations (26%) – Provide baseload power and reliable backup to intermittent wind and solar sources.

- UK nuclear power stations (14%) – Provide low-carbon baseload generation for the grid.

Source: Electricity mix contribution according to NESO British Electricity 2024 Review.

Electricity generators also include smaller-scale power producers, such as businesses with commercial solar panels that sell solar energy with power purchase agreements.

Electricity suppliers

Role: Buyer

Electricity suppliers are licensed by Ofgem to purchase electricity on the wholesale market and sell it to individual homes and businesses.

Examples of electricity suppliers include Octopus Business Energy, EDF Business Energy, and Scottish Power Business Energy.

Electricity traders

Role: Buyer and seller

Traders buy and sell electricity from other market participants, but are not themselves generators or suppliers.

Electricity traders follow their own trading strategies in an attempt to generate profits.

The market benefits from the activity of traders, as they increase trading volume and provide liquidity.

Electricity importers

Role: Seller and buyer

Importers are businesses that trade electricity between the British electricity market and other countries using interconnectors.

Interconnectors are undersea cables connecting the British national grid to other electricity markets.

The British electricity grid currently has undersea interconnections with France, Northern Ireland, Ireland, the Netherlands, Belgium, Norway, and Denmark.

These connections allow electricity to flow in both directions, depending on market prices, system needs, and availability.

In 2024, net electricity imports via interconnectors made up 14% of Britain’s electricity supply.

Energy storage operators

Role: Seller and buyer

Storage operators own energy storage assets that can temporarily store electricity using pumped hydro or battery storage technology.

A storage operator purchases and stores electricity when prices are low, then sells it later when demand (and prices) rise.

Industrial consumers

Role: Buyer

Large energy users purchase electricity from the market using long-term Power Purchase Agreements (PPAs) or through short-term trading.

In either case, access to the market by industrial consumers is provided by licensed business energy suppliers.

Find out more in our guide to procuring renewable energy with a corporate PPA.

How electricity is traded

The wholesale electricity market in Britain is divided into four distinct sub-markets, each with its own structure and rules.

All electricity trading on the wholesale market is carried out in advance of a defined future delivery date.

The sub-market used for trading depends on how far in advance of the delivery date the trade takes place:

- Forward market – Years in advance, up to the two days before delivery.

- Day-ahead auction – The day before power delivery.

- Intraday market – Same day as delivery, up to one hour before.

- Balancing mechanism – Real-time trading adjustments.

Forward market

The forward market is where electricity can be bought or sold days, months, or even years in advance of delivery.

Trading in the forward market takes place directly between buyers and sellers through three distinct types of contract:

- Over-the-Counter (OTC) trades – Custom contracts between two parties that define bespoke agreements for price, volume, and duration. These transactions are often facilitated by brokers.

- Exchange-Traded Futures & Forwards – Standardised contracts for trading electricity for future delivery dates, actively traded on the Intercontinental Exchange and the EEX UK Power Futures markets.

- Power Purchase Agreements (PPAs) – Long-term contracts (typically 5–15 years) that renewable asset owners use to sell the electricity their investments will generate.

The forward market allows participants to plan and secure their electricity purchasing or sales well into the future.

Using the forward market enables energy suppliers to lock in prices for future electricity purchases, allowing them to offer fixed tariffs to their customers.

Day-ahead auction

The day-ahead auction is a structured auction that takes place the day before electricity is delivered. It is conducted separately for each of the 48 half-hour delivery periods for the following day.

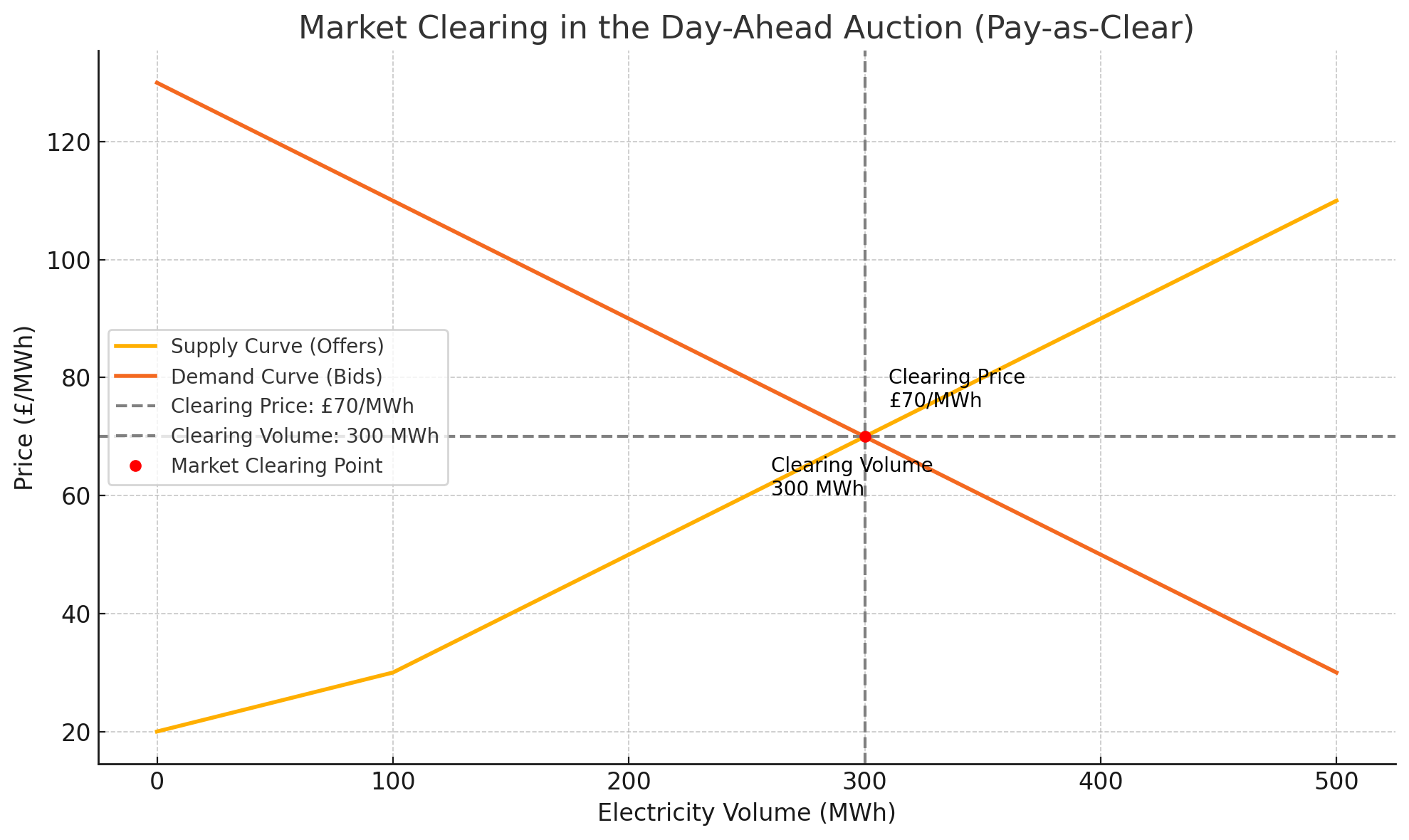

The auction sets a single wholesale electricity price for all successful buyers and sellers in each 30-minute delivery period. Here’s how it works:

- The market opens at 8 a.m. on the day before power delivery.

- Buyers submit bids to the market, specifying the volume (in MWh) they wish to purchase and the maximum price they are willing to pay.

- Generators submit offers to the market, specifying the volume (in MWh) they wish to sell and the minimum price they are willing to accept.

- The market closes at 11 a.m., three hours after opening.

- Bids are stacked by the market operator in order from highest to lowest prices; this is known as the demand curve.

- Offers are stacked from cheapest to most expensive; this is known as the supply curve.

- The auction determines a Market Clearing Point, where the supply and demand curves intersect on both volume and price (called the clearing price).

- Trades are executed for all bids above and offers below the clearing price. All successful trades are settled at the market-clearing price.

The graph below shows how the Market Clearing Point and clearing price are determined based on submitted bids and offers.

The calculation of the clearing price is completed by a market operator (either N2EX or EPEX SPOT UK).

The structure of the day-ahead market encourages honest bidding, where participants are charged the ‘fair market price’ rather than the price they bid.

This means that inflexible generators, such as nuclear power plants and wind farm owners, receive a fair market price, even though they may bid at zero or even negative prices to ensure their offers are executed.

Intraday market

The intraday market allows for last-minute buying and electricity. This is essential for renewable energy generators who continuously update their generation forecasts as the weather changes.

It also enables the market to adapt to unexpected issues, such as a gas power plant going offline for urgent maintenance.

The market opens after the day-ahead auction closes and remains open until one hour before each 30-minute power delivery window.

The intraday market operates on a continuous matching model for specific half-hour periods, similar to a stock exchange.

Trades on the intraday market are executed on the EPEX SPOT UK or Nord Pool trading platforms.

Balancing mechanism

The balancing mechanism is a final real-time market in which the National Energy System Operator (NESO) trades with other market participants to ensure that supply and demand on the grid remain finely balanced.

The balancing mechanism takes place when all other trading has ceased, in the final hour before power delivery.

The trades made by NESO are called ‘balancing activities’. Here are the most common examples:

NESO trades when demand exceeds supply:

- Pay gas power plants to increase electricity generation.

- Pay hydro storage plants to release stored water and generate electricity.

- Pay importers to move electricity through interconnections.

- Pay industrial users to reduce demand through the demand flexibility service.

NESO trades when supply exceeds demand:

- Pay gas power plants to reduce electricity generation.

- Pay wind farm operators to temporarily disconnect.

- Pay energy storage operators to charge.

- Pay exporters to move electricity abroad.

NESO selectively makes these payments depending on what is most cost-effective and based on the real-time requirements of the grid.

The balancing service providers listed above continuously submit bids to offer these services.

Since NESO is always the counterparty to these transactions, it is necessary to fund these activities.

Consumers of electricity pay for NESO’s balancing activities through BSUoS charges.

Wholesale electricity market settlement

In the section above, we summarised the four key ways in which market participants trade electricity with one another.

Once trading has completed:

- Each generator will have a contractual commitment to import a certain volume of power into the grid.

- Each supplier will have a contractual right to export a specific amount of electricity, which their customers will use.

The market settlement process corrects all participants’ positions so that their trading commitments match their actual imports and exports.

This is necessary because buyers and sellers in the market must make estimates when trading. For example:

- A solar farm owner will estimate how much electricity their panels will generate and sell electricity on this basis, but cloud conditions are constantly changing and impact generation.

- A commercial electricity supplier must estimate the business energy consumption of their customer base, but actual usage may differ.

The wholesale market settlement process pays or charges market participants a system price per kWh to settle the imbalances between their contracted and actual positions. Here are the individual steps:

Capturing final contractual positions

At the close of the intraday electricity market, each market participant submits their final contract position one hour before delivery for the upcoming half-hour period.

For most participants, the final contract position represents their best estimate of what they will actually export to or import from the grid.

This data is shared with Elexon, the market settlement body, through an automated reporting system.

Metering of actual volumes

Each market participant’s actual generation or consumption is measured by electricity meters that record power imports or exports every 30 minutes.

These electricity meters are installed at:

- The point where large generators connect to the grid

- The point where interconnectors connect to the national grid

- Energy-intensive commercial properties with half-hourly electricity meters

- Smaller commercial properties with smart business energy meters

- Individual homes using smart meters

The meter reading data from these meters is collected and submitted to Elexon’s settlement system.

Calculation of energy imbalance settlement

Elexon calculates each market participant’s imbalance volume by comparing their contractual position against their actual position.

Elexon then charges or pays the system price, which is equal to the price paid by NESO in the balancing mechanism:

- Participants who over-deliver (or under export) are paid the system price for each MWh of excess power.

- Participants who under-deliver (or over export) pay the system price for each MWh of deficit power.

Market-wide half-hourly settlement reform

Elexon takes up to 14 months to finalise the settlement process for an individual 30-minute period.

The principal reason for this delay is the manual meter readings required by older types of electricity meters, which may occur as infrequently as once a year.

Ofgem is leading a Market-Wide Half-Hourly Settlement reform to accelerate this process.

Find out more in our guide to what market-wide half-hourly settlement means for businesses.

Supply and demand fundamentals

The wholesale market price for electricity directly affects domestic and business electricity bills paid by consumers.

The trade prices for power in each sub-market of the British wholesale electricity market are influenced by the relative supply and demand levels.

The forward market price is shaped by the market’s long-term expectations of overall supply and demand, while short-term market prices are influenced by immediate factors such as the weather.

This section explains the key factors driving supply and demand in the wholesale electricity market.

Electricity demand

Electricity demand from consumers constantly fluctuates and must be met in real time by the grid to avoid blackouts.

Key drivers of demand include:

- Time of day – Demand peaks in the morning and early evening.

- Weather – Cold weather increases heating load; hot weather increases air conditioning use.

- Economic activity – Greater industrial and commercial usage occurs during working hours.

- Consumer habits – Popular TV shows, mealtimes, and holidays all create distinct demand patterns.

Multi-rate business energy tariffs encourage businesses to reduce their consumption during periods of highest demand on the grid.

Electricity supply

Electricity supply depends on the availability, flexibility, and cost of different types of power generation.

Generators in the British electricity market can be categorised as follows:

- Baseload generation – Nuclear power plants that provide stable power output but cannot be quickly ramped up or down.

- Renewables – Wind and solar farms that have zero marginal cost but are dependent on the weather.

- Peaking generation – Gas power plants that can quickly adjust their output to provide more or less power.

- Storage – Batteries and pumped hydro plants that can shift supply across different time periods.

The wholesale electricity market structure means that supply from baseload and renewable generators is always prioritised and used first.

The impact of decarbonisation on the wholesale electricity market

The UK government is working to decarbonise the national grid by 2030 as part of its transition to net zero.

This process involves moving away from fossil fuel-based power generation towards intermittent wind and solar power, supported by a baseload of low-carbon nuclear power stations.

In this section, we’ll explain how decarbonisation is affecting the wholesale electricity market.

More variable power supply

Electricity on the national grid is increasingly being generated by onshore and offshore wind farms, many of which are subsidised through the Contracts for Difference (CfD) scheme.

Power generated by wind farms is unpredictable and weather-dependent, which is introducing greater price volatility into the market.

Flexible energy grid

Renewable energy variability creates a financial opportunity for market participants that can provide flexibility to the market. This is resulting in:

- Construction of large-scale hydro storage sites.

- Investment in grid-scale battery storage.

- Integration of domestic and commercial solar batteries with solar panels.

- Large business energy customers strategically reduce demand to earn revenue through the Demand Flexibility Service.

For more information, visit our guide to the flexible energy grid.

Why the wholesale market matters to businesses

The wholesale electricity market isn’t just a background mechanism, it is a major factor in determining energy bills.

At Business Energy Deals, we help our customers compare business energy prices. This section explains three key reasons why businesses should understand the wholesale electricity market to make informed decisions about their energy procurement.

Impact on business electricity prices

Wholesale electricity prices represent the majority of the underlying cost in business electricity prices per kWh.

The prices available for one, two, or three-year fixed business energy contracts are a direct reflection of the prices being traded on the forward wholesale electricity market.

Our energy experts help businesses find the most competitive rates for their energy costs. Use our business electricity comparison or business gas comparison services to find out how much you could save today.

Managing pricing risk

Procurement departments in large businesses can trade directly on the wholesale electricity market to execute their business energy procurement strategies. This can include:

- Hedging pricing risk by purchasing in the forward market

- Entering into long-term PPAs

Decarbonisation and brand strategy

The carbon footprint of electricity provided by the grid is a major source of emissions for many businesses.

To support their sustainability goals, many organisations purchase green business energy directly from the market through:

- PPAs with solar and wind farms

- Purchases of REGOs from the market